A better way to manage your money

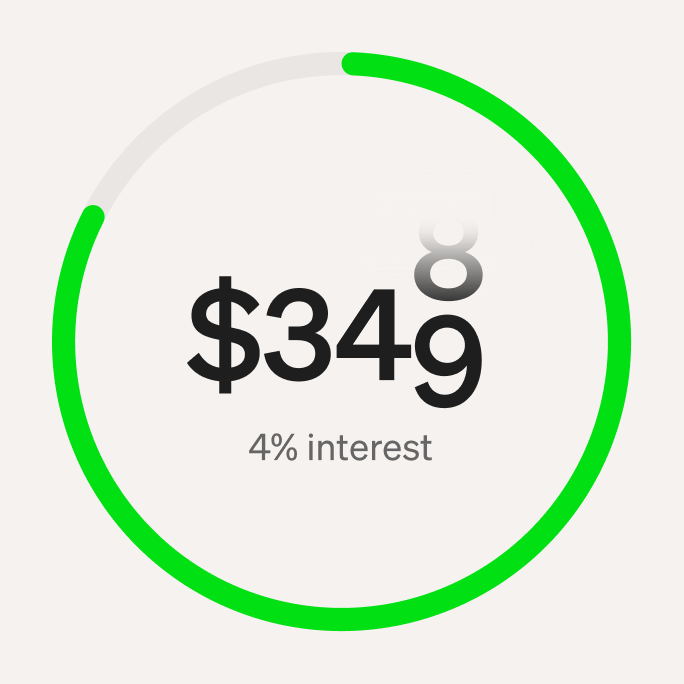

DIRECT DEPOSIT

Get the best parts of Cash App when you direct deposit $300 in paychecks each month.

Direct deposit provided by Cash App, a Block Inc. brand.

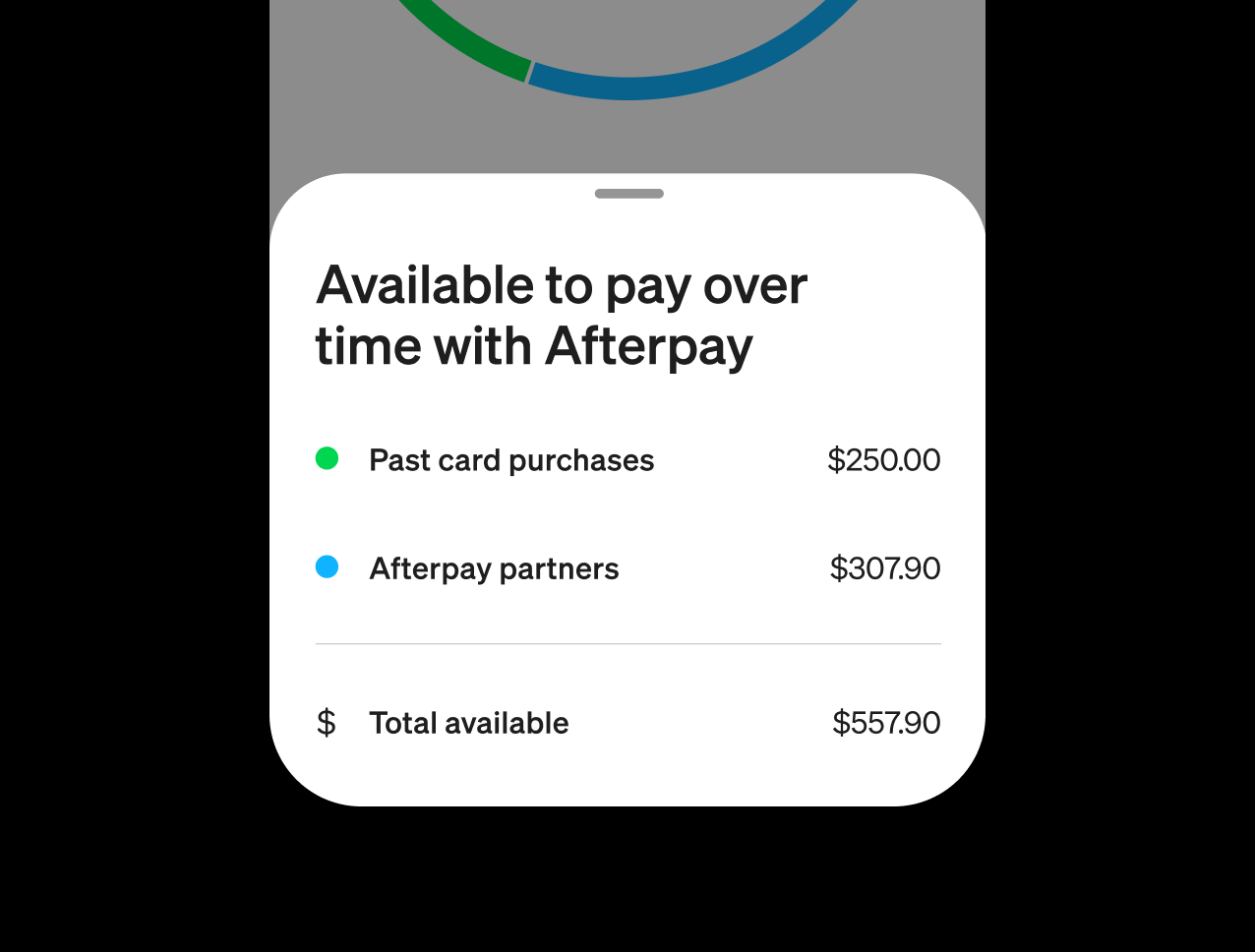

CASH APP AFTERPAY

Choose the most flexible way to pay over time with no hidden fees or impact to your credit score.

Editor’s Choice on the App Store

Apple App Store and Google Play reviews

Rated Excellent on Trustpilot

SEND AND RECEIVE

Instantly send, receive, and transfer money for free.

CASH APP CARD

Introducing the Tortoise Card. It’s a new classic.

Prepaid debit cards issued by Sutton Bank, Member FDIC. See Terms and Conditions.

Make your money go further

Bitcoin services provided by Block Inc. Bitcoin services are not licensable activity in all U.S. states and territories. Block, Inc. operates in New York as Block of Delaware and is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Trading bitcoin involves risk; you may lose money. Brokerage services by Cash App Investing LLC, subsidiary of Block, Inc., member FINRA/SIPC. Investing involves risk; you may lose money.

Mobile banking built for security

24/7 fraud monitoring

Real-time transaction alerts

Card lock and security lock

Explore more

File your taxes

for free

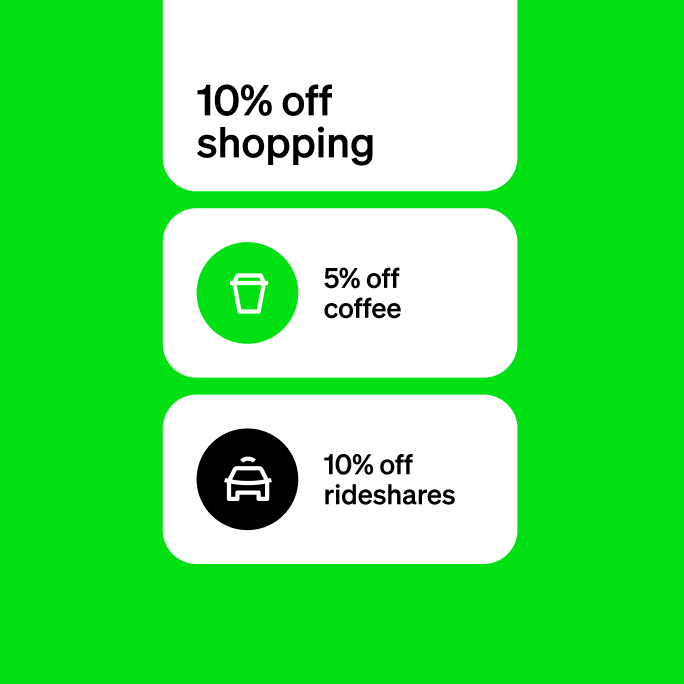

Save on everyday spending