OUTSMART SCAMS

Survey scams: What’s real and what isn’t?

Scammers try to take advantage of how people take surveys without thinking about the info they’re sharing. After just a few questions, you might give your address, phone number, email address, or financial information to a scammer who wants to steal your info.

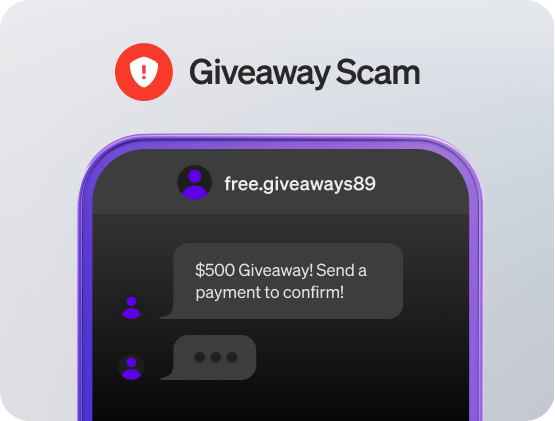

Fake surveys are designed to look legit, and they promise easy rewards or giveaways for your time. When you know how to spot fake surveys and the common tricks they use, you can help keep your money safe.

Does taking surveys really pay?

There are fake surveys, but there are also real surveys, where market research companies learn from their customers and occasionally pay them for participating.

Because of this, it makes knowing how to recognize which surveys are scams that much more important. If a survey seems off, asks personal questions, or requires payment to continue, it’s probably a survey scam.

Are Cash App surveys for money real?

Cash App does market research and giveaways, but Cash App will never ask you to fill out a survey that promises money or other rewards in exchange for your personal information, like your login code or PIN. If a survey asks for your account info, it’s probably a scam.

How to spot fake surveys

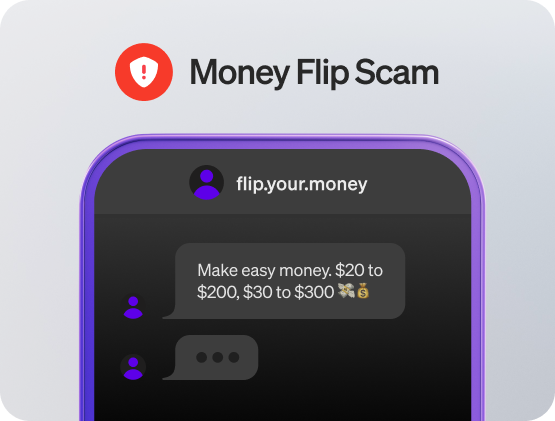

Scammers often send convincing emails and texts that promise easy money just for answering a few questions. They can be hard to spot, but here are a few survey scam red flags.

- Sent from an unknown number or sender: Legitimate survey and research companies ask you to sign up with them first.

- Required to make a purchase or payment: Fake surveys often require an upfront purchase or payment for "verification" or "processing fees.” They might add pressure or say you’ll be disqualified for not paying a fee.

- Sounds too good to be true: Real surveys typically don’t pay a lot. According to a survey study from NerdWallet, earnings ranged from $0.41 to $2.03 per hour. If it sounds too good to be true, it probably is.

- Asked to provide sensitive personal information: This could include your Social Security number, bank details, or PIN. Real surveys never ask for this type of info and will usually use a trusted payment method instead.

- Has bad grammar and spelling mistakes: If a survey has obvious errors in how it’s written, it could be a scam.

- Requires a very short timeframe: Real surveys should give you days or weeks to respond. Fake surveys often apply pressure to get your information.

- Includes suspicious links or attachments: Avoid clicking on links or downloading attachments from unknown or suspicious sources, even on a survey website.

- Comes from an incorrect or suspicious email address: Scammers often try to use an email address close to what you’d expect to trick you into taking the survey.

What to do if you take a fake survey

Scams and identity theft happen to millions of people every year, and survey scams are one of the most common ones. If you think you’ve taken a fake survey, here’s what to do:

- Don’t answer any more questions: If you haven’t completed the survey, stop.

- Change your passwords: If there were any accounts connected to what you answered in the survey, change your passwords and add 2-factor authentication to the accounts to keep them secure.

- Monitor your accounts: Check your bank statements and credit reports for anything unusual. Report any unauthorized purchases to your bank right away.

- Report the scam: File a complaint with the Federal Trade Commission (FTC). If the survey scam was on social media or email, report it to stop the scam from spreading further.

Stay safe from survey scams with Cash App

When you get a message or see an offer that seems too good to be true or doesn’t feel right, it probably isn’t real.

Remember that Cash App will never ask for your login information, send you money randomly, or require payment for a survey. If you find any of these signs of survey scams, report them to keep yourself and others safe.

To help protect you and your money, Cash App has advanced security features so you can send money safely. You can help keep your Cash App account secure by double-checking all recipient info before sending money, using Security Lock, and syncing your contacts in the Security & Privacy section of the app.