OUTSMART SCAMS

Money flip scams: Everything you need to know

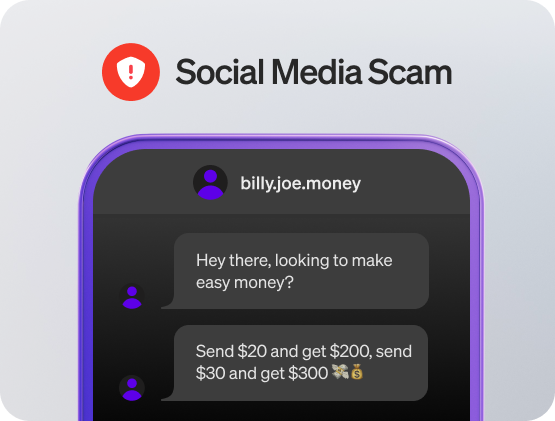

Ever see a social media post or message that promises fast cash if you just “invest” a little bit of money? There’s a good chance that it was a money flip scam.

These scams usually include “proof,” like photos of luxury cars or houses, that all came from their alleged investing strategy. Cash flip scams like these are fake—they’re designed to earn your trust, then take your money.

By knowing how to recognize these types of scams, you can avoid them and protect your money.

What are cash flips and how do they work?

With promises of a huge payout from their “expert” investing hacks, money flip scammers ask you to send them money to invest in a sure thing. They pretend to be professionals and will use many tactics to show how good they are at what they do, including fake bank balances, stories, and screenshots.

It might look legit at first, but it’s all a scam created to steal your money. Cash flip scammers can be very good at faking what they do, so it’s important to know how these scams work.

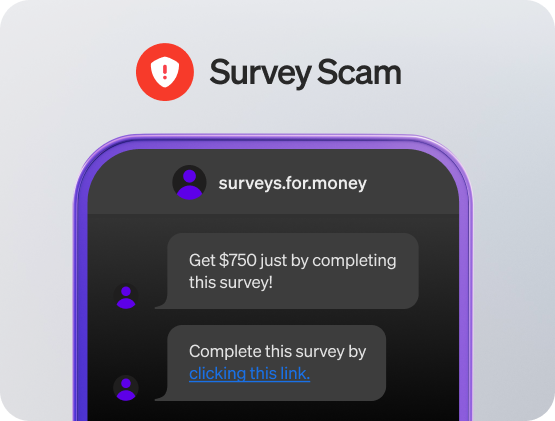

- Scammers try to get your attention Scammers draw people in by creating attention-grabbing social media posts or sending direct messages claiming they can “flip your money” for extra cash. They say they can turn a small investment into a lot more money fast. It sounds too good to be true because it is. These posts might come from a profile on social media platforms that looks real with promises of guaranteed returns, like “Turn $100 into $1,000 in 24 hours. DM me.” You might get a message that reads, “Hey, want to make $250 in a week?” When you see these cash flip claims, it’s best to block them and shut down the scam right away.

- They try to manipulate you If you respond to a message or comment on a post, scammers say whatever they can to convince you that the scheme is real with minimal risk. For example, you might get a message that reads, “Hey! I saw you were interested in making some quick cash. For a small $50 investment, I guarantee I can turn that into $500 overnight with my proven strategy! Just look at all these people I've helped get rich.” To show how they can flip money online, they might also send fake screenshots of bank accounts or made-up testimonials to convince you their scam is a real way to earn money. It’s not.

- Part of the scam is making a “test” payment After making hollow promises, scammers pressure you to make a small "test payment" to see their work in action. It’s all part of the scam. They build trust so that you’ll send more money later. That’s usually what they’re after. The scammer might guarantee it’s being “flipped” for a big return, but they come up with reasons to ask for more money, like fees, taxes, or promises of a bigger payout. These are all lies, and they keep pressuring you to send hundreds or even thousands more for a larger return.

- Scammers disappear with your money After they have your money, the money flip scam ends like you might expect. They disappear, and you’re left losing money. They stop replying once they’ve gotten all the money they can from you. They might even block you so you can’t report their account. At this point, if the scammer took your money, you should document the conversation and report it. It’s one way you can help shut down cash flip scams from stealing from more people.

How to avoid money flip scams

Now that you know how money flip scams work, here’s how to avoid them.

- Pay attention to red flags Money flip scams play on your emotions to steal your money. Real investments typically don’t involve fast money with no risk, and they usually don’t come from strangers sending you messages on social media. If you hear about a “unique opportunity,” especially from someone you don’t know, that’s already a red flag. No matter how convincing they might seem, anything that promises easy money without risk is almost always a scam.

- Use your instincts No matter who it comes from, posts or messages about cash flips are scams. If someone from your childhood makes an odd request for cash, or even if a family member or close friend starts posting about flipping cash, their account might be hacked. If it feels like a money flip scam, it probably is one. You should only send money to people you know in real life. By paying attention to your instincts, you can protect not only yourself, but your friends and family from scams.

- Report scam accounts If someone messages you on social media saying they can double your money or more through a flip, don’t respond. Report their account as a scam account. You can report accounts on Cash App from their profile. You can also take screenshots of their messages and claims. When reporting an account, you can use the screenshots as examples of how they’re scamming people. This can help companies shut down accounts faster to keep you and others safe.

Get help from a money flip scam on Cash App

Scammers are experts at manipulating people, and they scam people every day. If you’ve been scammed by a cash flip and sent money through Cash App, here’s what to do:

- Confirm it’s a scam: If you’ve experienced any of the signs of a cash flip, it’s probably a scam.

- Contact Cash App Support: Report fraud, suspicious activity, or a scam on the app or website.

- Get evidence about the scam: This could be screenshots of messages, transaction receipts, $cashtags, or something else. Proof helps our support team investigate and shut down scammers.

- Call your bank: If you linked your bank account to your Cash App account to make a payment, let them know about the scam. They may be able to reverse the fraudulent payment, especially if you have evidence.

- Report the scammer’s social media accounts: Shutting down their account prevents them from targeting more victims in the future.

- Block them: Whether it’s from your social media accounts, Cash App, email, or phone number, this stops them from sending more messages to try to scam you.

Cash App payments are typically instant and non-refundable, but reporting scams immediately is important to prevent fraud. The sooner you contact support, show your evidence, or call your bank, the better the chances of recovering your money before the scammer and your money can disappear.