Product News

Cash App Green Brings Banking Benefits to Millions More Customers

November 13, 2025

Customers can now earn Green status through qualifying monthly spend or paycheck deposits

Cash App Green includes new banking benefits including higher Cash App Borrow limits for eligible customers and personalized weekly discounts

Cash App today announced the launch of Cash App Green, a reimagined, more flexible status program which allows more customers to access the brand’s banking* benefits without hidden fees. Customers can now earn Green status by either spending $500 or more per month on Cash App (via the Cash App Card or Cash App Pay), or by depositing $300 in qualifying deposits per month. Today, more than 8 million actives are eligible for Green status and can access new benefits including higher Borrow limits and customized offers at their favorite stores. The announcement comes as part of Cash App Releases, Cash App’s first-ever bundled launch of new products and features for customers.

Cash App Green unlocks benefits often locked behind steady paychecks, large balance requirements, and credit scores – barriers that exclude millions of Americans with fragmented and variable income. And these requirements also don’t match many modern Americans’ financial behaviors and perceptions: in fact, nearly two out of three Cash App customers define their “primary bank” as where they manage their everyday spending, not where they deposit their paycheck.¹ Cash App Green was built to reward customers who spend and manage their money on the platform, and to provide them the benefits they want from a financial services partner including access to cash when they need it, greater flexibility, and special discounts without hidden fees.

"Banking benefits shouldn't be locked behind narrow definitions of how a customer is supposed to work or earn their income," said Owen Jennings, Executive Officer and Business Lead at Block. "With Cash App Green, we're building a more flexible banking benefits program that's shaped by our customers' feedback and how they're using the platform to manage their financial lives."

Better Banking* Benefits on Cash App

When customers earn Green status, they can unlock faster access to cash when they need it, better tools to grow their money, freedom from fees, and more - no matter how they pay or get paid. Cash App Green benefits include***:

- Access to higher Borrow limits for qualifying customers, without credit checks.

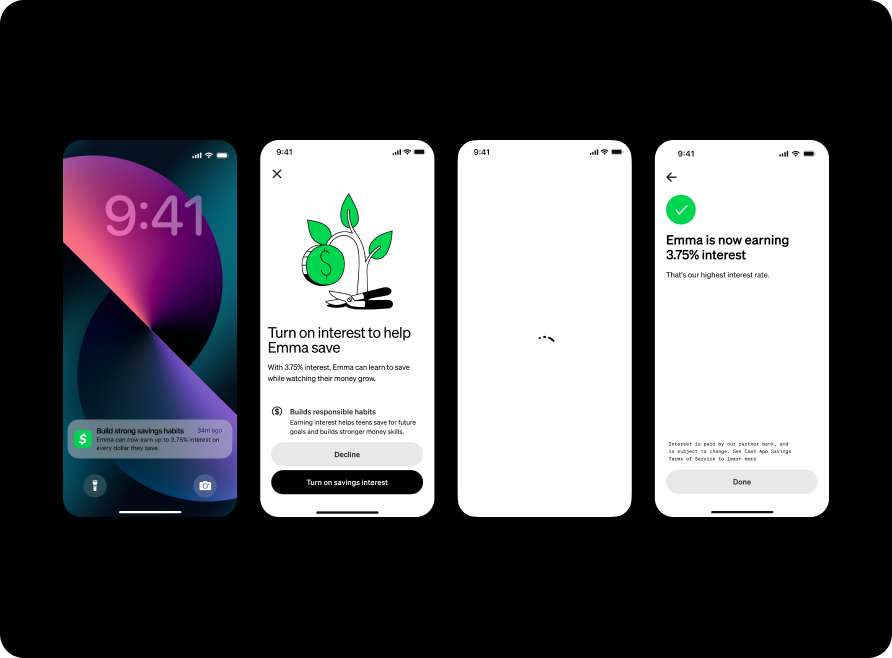

- Up to 3.5% interest on customers’ savings balances - Cash App’s highest interest rate.

- Access to free overdraft coverage up to $200.

- Five customized weekly offers at customers’ favorite stores, delivered every Friday.

- No fees for in-network ATM withdrawals, or paper money deposits.

- Priority phone support.

A Flexible Path to Green

Cash App Green benefits continue through the end of the following qualifying month and are available instantly once a customer has earned status. Cash App automatically tracks customers’ spending progress toward renewing Green status each month, which is viewable from the Money tab. And customers don’t have to qualify the same way each month to renew status; for example, if there’s ever a month where the customer doesn’t spend $500 on Cash App, they can deposit $300 in eligible deposits instead.

Cash App has also streamlined the in-app Money Tab to allow customers to get a snapshot of their finances within seconds. The customizable Cash App Card serves as a gateway to banking through Cash App, allowing customers to easily spend their Cash App Balance and access benefits including instant discounts, access to concerts and presales, built-in security features and more without hidden fees. To deliver a simpler, all-in-one banking* experience the Cash App Card and Money Tab experiences have been unified, creating an intuitive bridge between customers’ Cash balance, spending insights, and banking tools.

To learn more about Cash App Green, visit cash.app/new.

###

References

- Source:Curinos U.S. Shopper Survey 2024 (General Population N = 11,294 ; FinTech Primary N = 4,747; Cash App Primary N = 1,177 ; Cash App Non-Primary N = 5,704) | Q: “How do you define your primary checking account? Select all that apply”

About Cash App

Cash App is the money app. Banking* on Cash App is easy: customers can receive paychecks early with direct deposit, spend money where Visa is accepted with a personalized Cash App Card, and grow their money with a separate savings balance - all without hidden fees. Customers can also create a unique $Cashtag to share with anyone to get paid fast, make purchases with Cash App Pay, trade stocks and buy and sell bitcoin**. With Afterpay*, customers can also pay over time in a way that best fits their financial needs through participating merchants or directly in the app. Download Cash App for free at cash.app/download.

*Cash App is a financial services platform, not a bank. Banking services provided by Cash App’s bank partner(s). Prepaid debit cards issued by Sutton Bank, Member FDIC. See Terms and Conditions. Direct Deposit provided and Savings by Cash App, a Block Inc. brand. Discounts,Offers, and no-fee overdraft coverage provided by Cash App, a Block, Inc. brand. Offers not affiliated with third party merchants. Afterpay is offered and managed through your Cash App account - no Afterpay account needed.

**Brokerage services provided by Cash App Investing LLC, member FINRA/SIPC, subsidiary of Block, Inc. Stablecoin, Bitcoin Map, and Lightning Network are not available to New York residents.Bitcoin services provided by Block, Inc. Bitcoin services are not licensable activity in all U.S. states and territories. Block, Inc. operates in New York as Block of Delaware and is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Investing and bitcoin are non-deposit, non-bank products that are not FDIC insured and involve risk, including monetary loss. Cash App Investing does not trade bitcoin and Block, Inc. is not a member of FINRA or SIPC. For additional information, see the Bitcoin and Cash App Investing disclosures.

***Cash App Green benefits:

- Higher limits for borrowing cash: Unlock Borrow limits up to $400 for first time borrowers, and get limit increases of up to $300. Borrow eligibility and limits depend on several factors and are not guaranteed. There are multiple ways to increase your Borrow limit, see here for more details. Borrow limit increase for spending may be lower than limit increase for depositing. Limit increases are subject to change. Borrow is not available in Colorado or Iowa. Borrow loans serviced by Square Financial Services, Inc. issued by First Electronic Bank or Square Financial Services, Inc.

- Free overdraft coverage: Free overdraft coverage of up to $200 for Cash App Card transactions . Eligibility requirements apply, see terms for details.

- Free in-network ATM withdrawals: Cash App reimburses ATM fees for all in-network withdrawals when you deposit at least $300 monthly of Qualifying Deposits into Cash App, or spend $500 or more in Qualifying Purchases using your Cash App Card or Cash App Pay in a calendar month. Service fees may apply. See terms for more details.

- Savings Interest: Cash App will pass through a portion of the interest paid on your savings balance held in an account for the benefit of Cash App customers at Wells Fargo Bank, N.A., Member FDIC. To earn the highest interest rate on your Cash App savings balance, you need to (a) have a Cash App Card or sponsor one or more sponsored accounts and receive at least $300 in paycheck direct deposits each month; or (b) have a sponsored account with sponsor approval to earn interest. Exceptions may apply. Savings yield rate is subject to change.