OUTSMART SCAMS

How to identify a scam and stay safe online

Online scams can happen to anyone. Not only can they make people lose money, they can be very stressful to deal with.

It’s important to learn how to identify a scam before it happens in order to keep your money safe. With social media, banking, and messaging apps, scams have become more sophisticated and convincing over time, which makes it harder to avoid being scammed online.

The better you know how to spot a scam, the better you can outsmart scams.

How to spot a scam

There are tons of scams out there, and scammers are getting more creative every day. However, there are common ways to identify a scam.

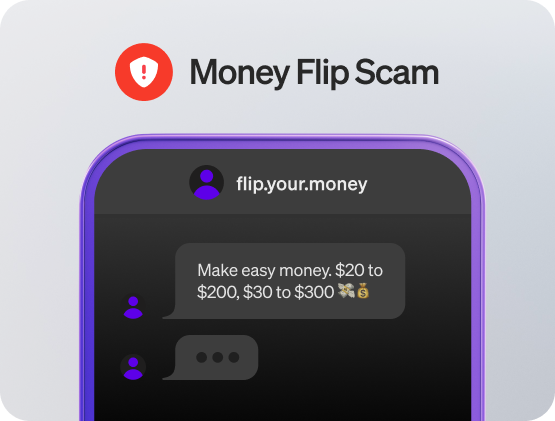

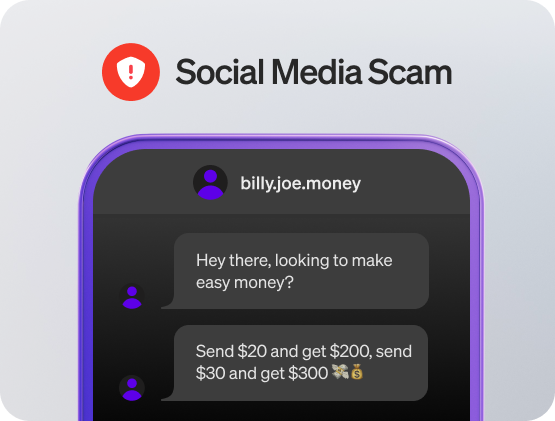

- It sounds too good to be true Many online scams start with a promise of free money, gift cards, luxury items, or expensive giveaways for little to nothing in exchange. It might sound like a can’t-miss deal, but scammers always want something in return, like money or your birth date, Social Security number, or password. If they get what they want, you’ll probably never hear from them again. When someone promises you a deal that sounds too good to be true, it probably is. You can avoid being scammed online and protect yourself from identity theft by recognizing offers that just don’t seem to add up.

- You don’t know who’s contacting you

When you get a call, email, or text from someone you don’t know asking for your information or online account info, it’s probably the start of a scam. Just because someone knows your phone number or email address doesn’t mean you can trust them.

Scammers can find your contact info from many different sources, including public records. They often pretend to work for a government agency, like the IRS, or a debt collection company. They do this to scare you into sending them money or sharing info they can use to steal your identity.

To avoid scams, check that the phone number or email address they’re contacting you from is legit by searching for it online, or try to contact the company using the contact info you already have for them. If something doesn’t seem right or match up, don’t respond.

They often pretend to work for a government agency, like the IRS, or a debt collection company. They do this to scare you into sending them money or sharing info they can use to steal your identity.

- It's an urgent request

Scammers often try to pressure people into giving away their personal info or money by creating “urgent” situations full of empty threats or promises.

These types of scams take advantage of people panicking or reacting before they can think about confirming what the scammer says is real.

- Limited-time offer: With the promise of a prize or reward, scammers ask for money or personal info they need “right now,” or else you’ll miss out on an alleged, once-in-a-lifetime opportunity.

- Hacked account: Scammers pretend to be from customer support and claim someone hacked your account. They ask for personal or banking info that they say they need to verify your identity, and then use that to steal your money or get into your account. Never provide sensitive account details or passwords to customer support.

- Owed payment: Whether they say they’re calling about a mortgage, credit card, or something else, scammers say you owe money on an account. They use scare tactics, like threatening legal action, and say you need to transfer money to an unfamiliar account right away.

- Family emergency: Scammers know that many people will do anything when there’s an emergency in the family. They ask you to send money to help a family member, or the made-up situation will get worse. Always confirm the emergency before sending any money.

- You’re asked to share personal information Scammers try to trick people into sharing different types of personal info to gain access to their money. This isn’t limited to Social Security numbers or bank account info. They are often looking for usernames, passwords, PINs, birthdays, and answers to security questions. If they get the info they need, they use it to open accounts or loans, get access to accounts, or contact companies to gather even more information about you. In general, reputable companies don’t ask for sensitive information in emails or unexpected phone calls. Be careful about sharing your personal info to avoid being scammed online.

- It requires an unusual payment

If you’re ever asked to pay for something in an odd or unfamiliar way, it could be a scam. Scammers often want to use payment methods that are difficult to track, like wire transfers, gift cards, or bitcoin.

To keep your money safe, only send payments to people you know using trusted payment methods. Here are a few different ways to know how to spot a scam like this:

- You’re asked to send money to an unfamiliar account or using a payment method that seems unusual.

- Instead of asking for money, a scammer might tell you to buy and send a gift card or a photo of the gift card number and PIN.

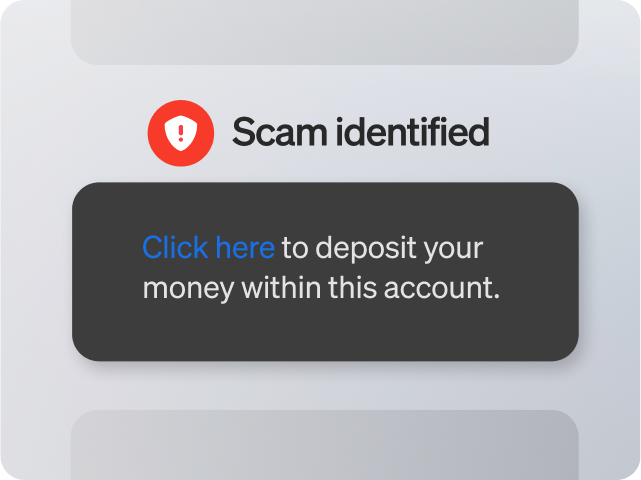

- You may be asked to deposit money into an account you don’t own.

- You receive a payment request through an app or website you’ve never heard of.

How to avoid potential scams

Knowing how to identify scams like these can help keep your money safe, but there are even more ways to avoid being scammed online and protect yourself:

- Don’t open suspicious emails, texts, links, or attachments: If you don’t recognize a phone number or email address, delete the message or report it as “spam” without opening it. Also, avoid opening any unusual links or attachments.

- Confirm who’s contacting you: If you don’t know the person, check their contact details with their company to make sure they match up. If anything doesn’t feel right, hang up or don’t reply. If you’re not sure, you can always call the company’s official phone number instead.

- Check for misspellings: If an email or text message has strange grammar, misspellings, or slight changes to an email address that don’t match the company, it could be a scam. Report it and delete the message.

- Don’t respond to unexpected, urgent requests: If someone is pressuring you to act quickly on something you aren’t aware of, stop engaging. Before sending money or any information, take a minute to verify the situation is real.

- Protect your personal and financial information: Whenever someone asks for your info, confirm that the person asking for it is who they say they are by searching online for their email or phone number.

- Check claims or transactions: If someone claims you owe money or your account is hacked, check your accounts to see if what they’re saying is true.

Keep your money safe with Cash App

To help avoid potential scams, here are a few more tips to keep your money and account safe with Cash App:

- Keep your login code safe: When logging in, make sure that you never share your code with anyone else, even people pretending to be from Cash App. Our support team will never ask for your code.

- Pay attention to account alerts: Cash App can notify you by text or email after every transaction. You can also get alerts when a new device logs into your account or makes security settings changes.

- Turn on Security Lock: Add an extra layer of security to your account to confirm it’s you before you move money or unlock the app.

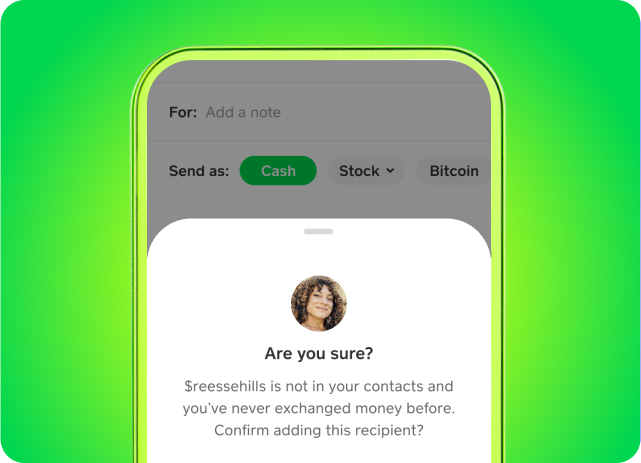

- Verify recipient Info: Verify and double-check all recipient info before sending a payment to confirm you’re sending money to the right person.